Good morning!

It’s been a week since I launched. I’m overwhelmed with all the support I’ve received. Thank you. I have grown to over 100 subscribers including 25+ founders and team members from Stan (last week’s deep dive), Amazon, Goldman Sachs, Meta, Stripe, and JP Morgan.

Here’s what’s in store for you today:

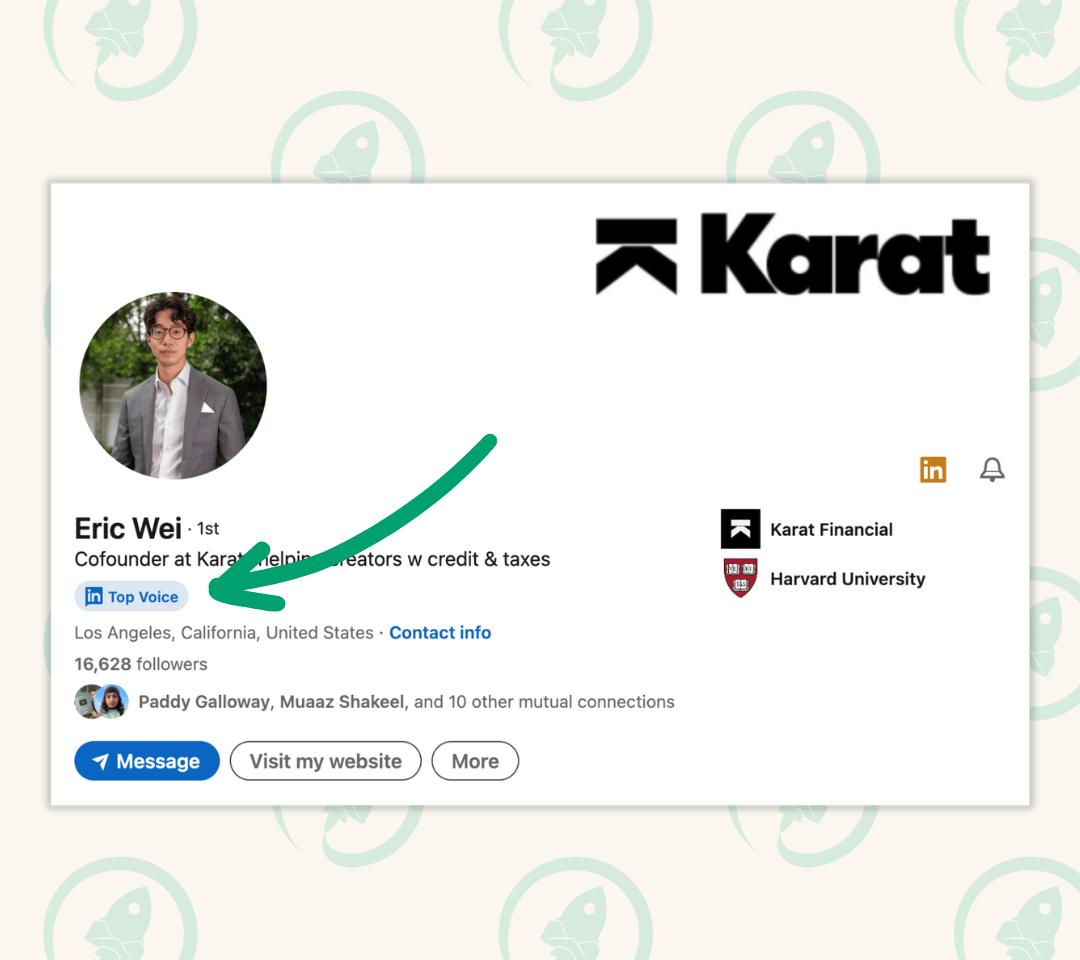

Karat: $100M to build a bank for Creators

Eric Wei and Will Kim met in 2016 playing board games at a friend’s house.

Little did they know just seven years later they would have raised over $100M dollars to build the financial infrastructure to support the Creator Economy.

At the time, both Eric and Will were racking up traditional status symbols like they were Pokemon, i.e., catching them all.

Eric is an ex-Instagram, McKinsey, and Blackstone Harvard grad. While Will is an ex- Palantir and Goldman Sachs Special Situations Group (i.e., the Goldman Sachs of Goldman Sachs) Stanford grad who raised $5M for his own VC fund after dropping out of his Masters.

But during this process of collecting corporate infinity stones. Both Eric and Will realized they wanted something more. They wanted to define their own paths.

And so, Karat was born.

In four and a half years Karat has raised over $100M from leading VCs, Creators, and Celebrities. Providing financial services to creators with over 1B combined followers.

Karat are on a mission to help creators establish themselves as businesses by improving their financial access.

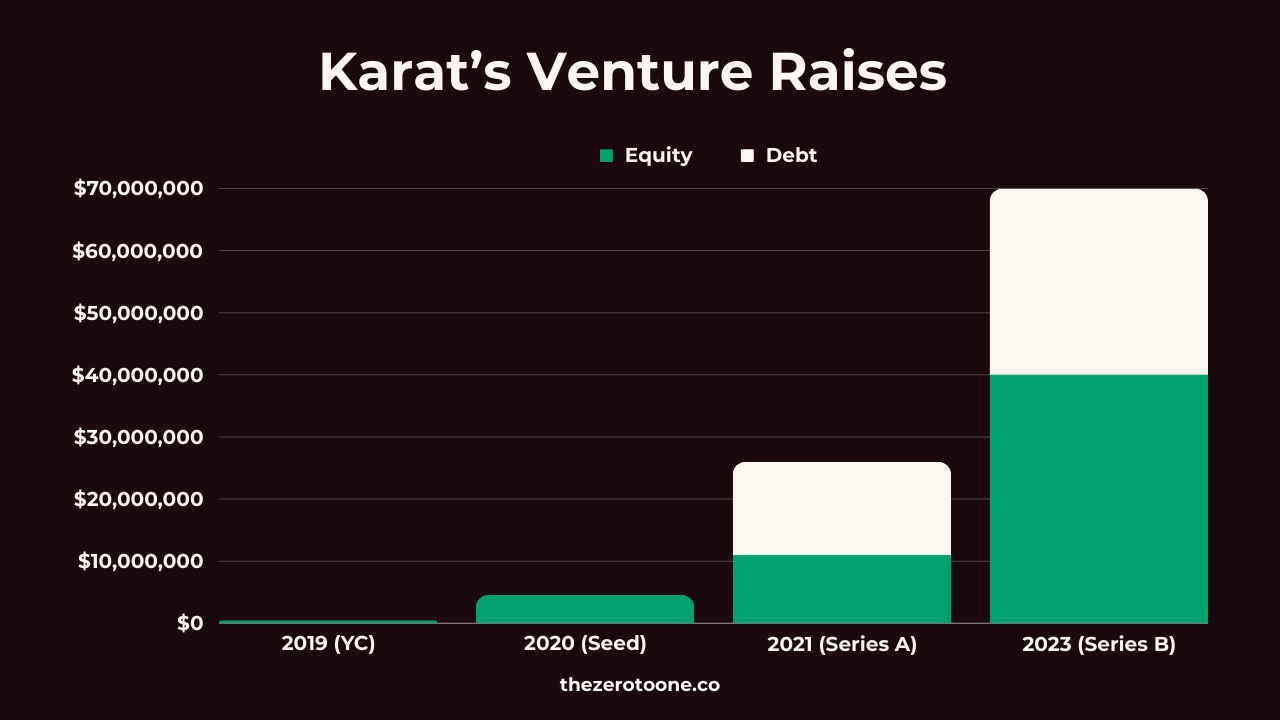

Karat closed a $70M ($40M equity) funding round in 2023, along with a new partnership with Visa. But this isn’t about what’s to come.

This is the story of how Karat went from Zero to One. 🚀

Business model: How Karat makes money

Simply put, they don’t.

At least not yet.

They don’t even charge fees for their credit card. Only making money from marginal transaction fees.

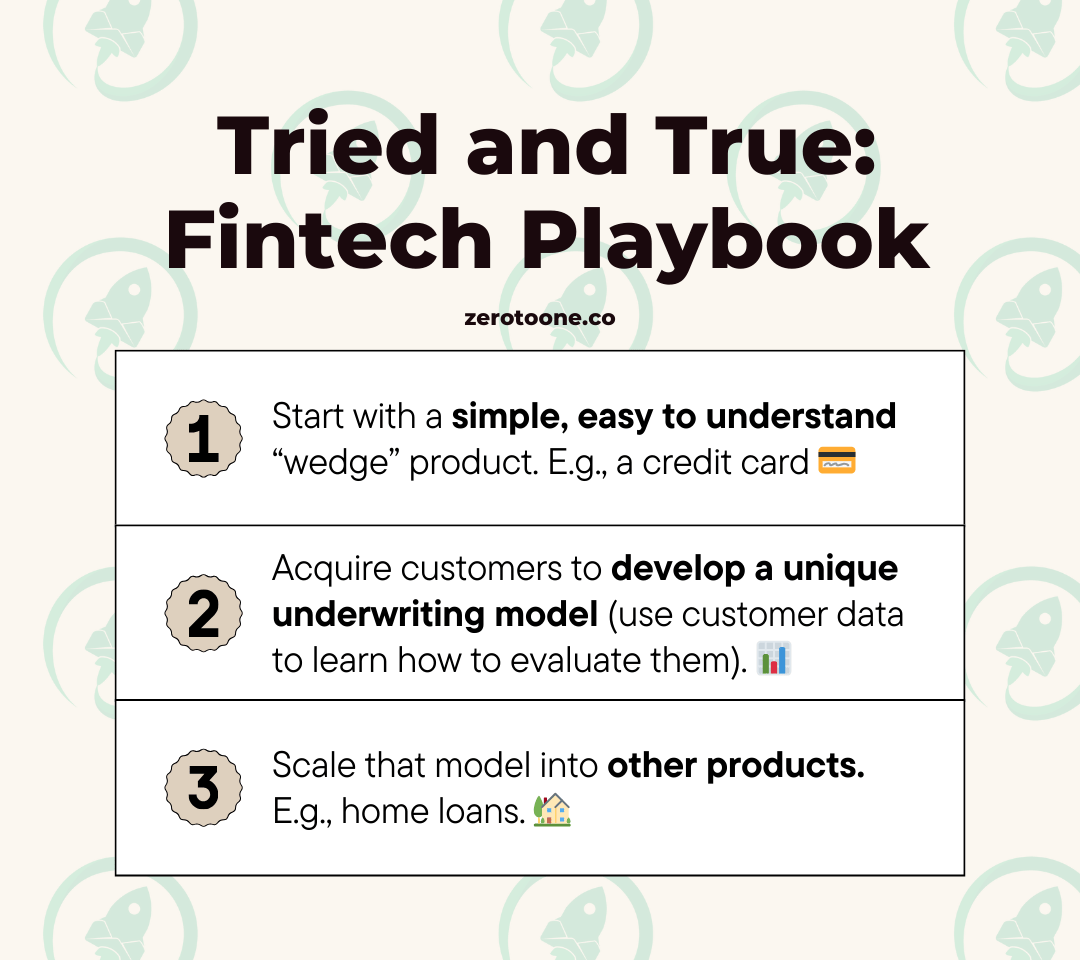

But that’s intentional. There’s a tried and true fintech playbook (which is actually more a data play):

Start with a simple, easy to understand “wedge” product. 💳

Acquire enough customers to develop a unique underwriting model (i.e., with your customers data). 📊

Scale that model into other products, for example home loans. 📈

There’s a great quote by Jamie Dimon, CEO of JPMorgan Chase, when answering a reporter on how much money the Chase Sapphire Reserve Credit Card had made.

He tells the reporter that the card has made negative $200M. But he wishes it made negative $400M. Because all the expenses for the card were in the first year of acquisition, but there was a high chance you’d switch over to a bank account and other Chase products.

So in the long-term, they would make money from you.

Up to now, Karat has focused on building their wedge product, a business credit card for creators, and acquiring customers to build an underwriting model which uses social stats (followers, growth, engagement, and platforms to name a few) and a creator’s financials to offer them higher limits and better rates than traditional banks.

After their last raise however, Karat have stated they intend to use the capital to scale into other products.

And we’ve already started to see it. Karat now offers bookkeeping and taxes as an upsold-service.

You may be asking: Is the Creator Economy even big enough to have its own banking system.

The founders of Karat believe so. And I agree with them.

According to VC firm SignalFire, there are currently over 2M creators who make more than $100k per year (at a minimum that’s $200B 💰), and over 45M more who make part-time incomes.

This is a huge market. Goldman Sachs estimates that by 2027 the Creator Economy could reach $450B+.

And Karat wants to be the financial infrastructure that enables it.

Karat’s growth

Karat’s growth is a bit of a guarded secret.

What we do know:

From launch to July 2021, i.e., for the first two (and a bit) years, Karat grew 50% month-on-month.

In this same time, they handled eight figures in transactions.

Karat’s customers have a combined following of over 1B - that is INSANE. That would be equivalent to 4 MrBeasts, 60 KSIs, or 715 Colin and Samirs.

So, let’s look at their growth from a capital perspective.

Eric and Will looked at the venture rounds for Karat as each answering a different question:

Seed: Are creators a big enough market? 🔎

Series A: Are creators businesses? And what is the right product to prove this? 🏭

Series B: Can they be cross- and up-sold on other products? I.e, can Karat become profitable? 💸

Karat raised $4.6M in Seed funding, after going through Y Combinator - where they constantly iterated on their wedge product. Eventually landing on the business credit card.

Then Karat raised $26M to test if Creators can be treated as businesses. Which they did through their business credit card, with customer spending power increasing 4x, with no defaults.

Karat most recently raised $70M to test if they can use their unique underwriting model to expand into other products for creators.

Now they need to find the next product in the sequence and scale that to their existing customers.

Key Success Factors (KSFs)

There have been plenty of reasons for Karat’s success and rapid growth. Here are 4 that really stood out to me:

🔁 1. Pivoting to find PMF: Eric and Will understood that they needed to test different ideas to find a product that was intuitive for creators to understand while also meeting an urgent enough need.

📷 2. Building for an underserved market: Karat identified and serves a high-income market that needs more financial access due to being misunderstood and underserved by traditional financial institutions

👯 3. Leveraging creators as connectors: The beauty of a business in the Creator Economy is that creators are inherently connectors - they share what they know and like to their already established distribution channels. And Karat has leaned into this heavily to grow their business.

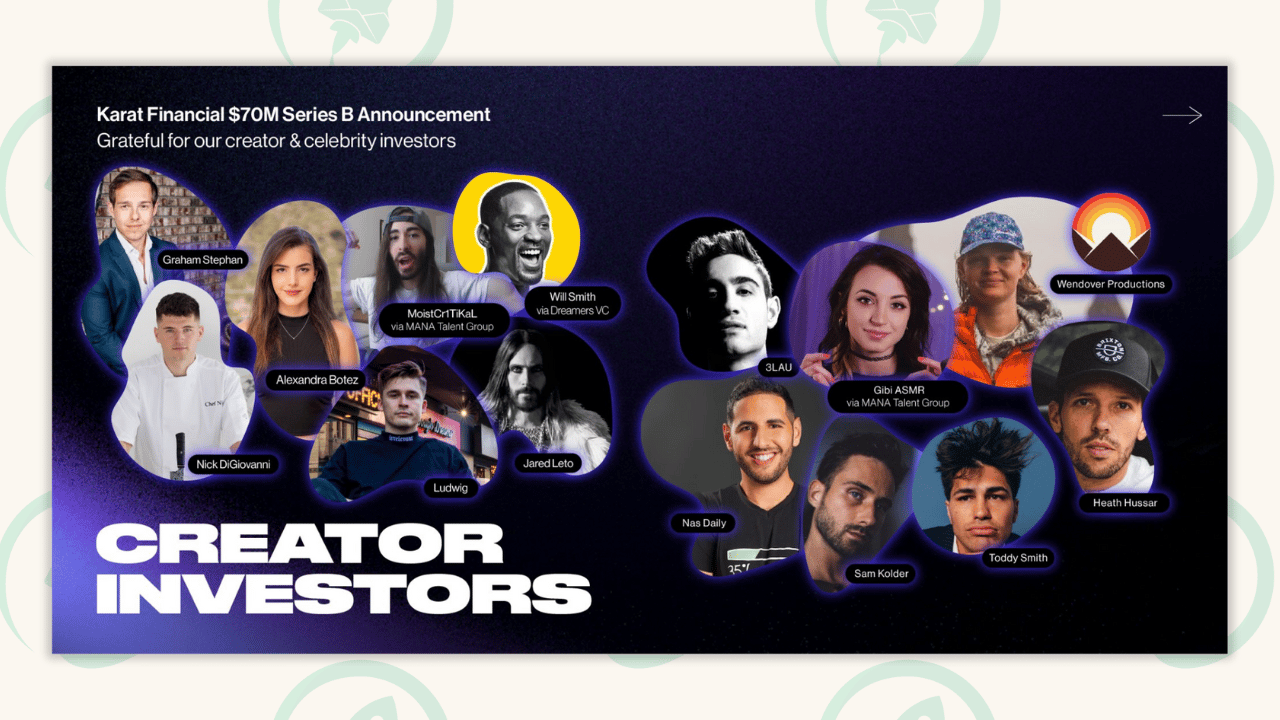

💳 4. Being intentional when raising money: Founders Eric and Will were extremely intentional with whom they raised money from. Bringing on top creators such as Graham Stephan and Alexandra Botez as well as industry experts, such as Co-Founders of Twitch, Twitter, and YouTube as investors. Will and Eric were also very clear on why they were raising money each round, i.e., they raised for a specific reason each time.

🔁 1. Pivoting to find PMF

Karat didn’t start as a business credit card for creators.

But rather as business capital for creators.

There were a few problems with this however:

Wasn’t intuitive to creators. Using other people’s money to fund things like merch or other products wasn’t easily understood. This meant that they generally had to work through middlemen. Never building direct relationships with creators nor collecting enough data to expand their product offering.

One-time use. Creators were using the business capital for one-time purchases like clothing for merch. Meaning Karat did not have a recurring and predictable stream of revenue.

Creators didn’t trust it. At one point Karat tried to give out PPP (US Covid relief stimulus for small businesses). The government was giving out free money and Karat was trying to get it to creators to grow their businesses. But they just didn’t trust it. They thought they were being scammed.

After this didn’t work, Karat tried creator taxes. One big problem though:

No one likes talking about taxes.

And when they do talk about tax it’s with someone they already trust and know.

Meaning they had to build trust in another way before they could offer tax services.

Enter the Karat business credit card.

A credit card for creators.

They knew they were on to something with the credit card when a massive creator (10M+ followers) reached out to them and told them to “not f*ck this up” - their first proof-point.

📸 2. Building for an underserved market

Traditional banks don’t understand creators. And they don’t know how to properly evaluate a creator’s creditworthiness.

Traditional banks use FICO to evaluate a person’s creditworthiness, which mainly looks at your history of taking out credit and paying it back.

However, this leads to two issues for creators:

Creators don’t have traditional income streams. Banks just don’t understand how creators make money. With many instances of them thinking its something illegal. 🕵️

Creators are often young. They don’t have a history of credit. 🐣

Because of this, creators making millions of dollars are being rejected for personal and business credit.

For example, Nas Daily, a global video creator, Harvard Econ Grad, and former Venmo software developer, was rejected for a business credit card.

He was making $3M+.

And traditional banks still didn’t trust him with financing.

Or Alexandra Botez, a chess Twitch streamer, Stanford Grad, and former YC backed-founder, who was rejected on two different occasions for a business credit card.

She had over 875k followers and ~2,500 subs on Twitch at the time.

At an average of $5/sub that’s $12.5k/month in just subs. Add in her sponsorship revenue and ad revenue from other platforms (like YouTube, where she was getting ~10M views per month) and she was probably earning closer to $50-70k/month.

Yet she was still rejected.

Alex Botez opening a Karat account (I’m guessing)

It was clear to Karat that creators, even the top-earning ones, were being underserved by traditional banks. Limiting their growth and revenue potential. 📉

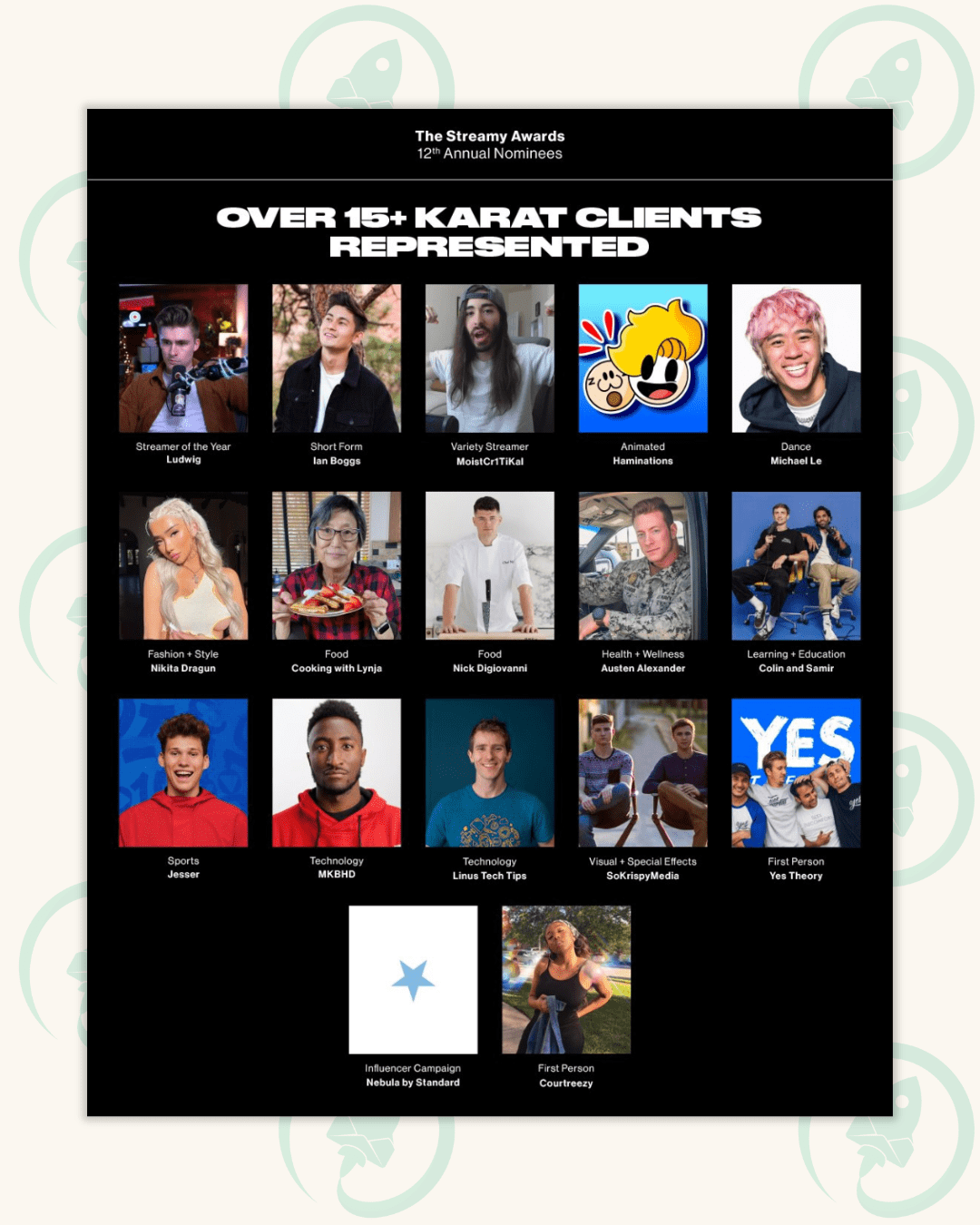

In fact, their second proof-point for the credit card came when watching a Ludwig stream (~5.7M subscribers).

During a stream his credit card kept declining. He was reaching his credit limit.

So Karat cold-emailed his team while he was live.

They saw it. Ludwig signed up.

And still uses Karat today. In fact, they eventually brought Ludwig on as an investor. But more on that later.

As mentioned earlier, what makes Karat unique is how they underwrite (i.e., evaluate) creators’ creditworthiness.

Instead of using traditional metrics (FICO). Karat uses an underwriting model which evaluates creators based on their income, the sources of that income (for example, Twitch subscriber income is more predictable, almost SaaS like, than TikTok ad revenue), and social stats such as subscriber/follower count & growth, as well as engagement.

Because of this, Karat is able to offer higher limits and better rates for creators than traditional banks are able to.

Creators also tend to not be particularly financially savvy. They’ve never thought about taxes, business capital, or write-offs before.

For almost all creators, Karat will be the first company they trust with their finances.

Karat makes this transition to trust as easy as possible: hosting a podcast with leading creators (building top of the funnel trust) and then providing awesome customer service once a creator becomes a customer. For example, providing financial advisors to creators along with their credit card.

This multi-layered trust building has lead to loyal customers who become brand ambassadors.

Talking about brand ambassadors…

👯 3. Leveraging creators as connectors

Creators love to share. It’s part of the job description.

In the international #1 bestseller, The Tipping Point, author Malcolm Gladwell identifies three crucial types of people needed for a product to reach a tipping point - i.e., spread like wildfire, or in the creator world, go viral.

Connectors: Usually know and keep in touch with a lot of people. These are people with a special gift with linking us to the world.

Mavens: Information specialists. They know what’s hot and what’s not. These are the people who amass loads of information and love to share it.

Salesmen: Able to build instant rapport with people. Charismatic. Find it easy to gain the trust of others. These are the people who are socially contagious - who make others feel good about themselves.

The awesome thing about creators is that they are all three combined.

That is very rare.

But extremely powerful.

Karat have used this as a superpower in growing their business. Leveraging creators ability to navigate all three:

Connecting Karat with other creators as well as their audience (where other creators also often hang out).

Using their social authority to influence other creators to use Karat. Alexandra Botez, Graham Stephen, Ludwig… all know what’s hot and what’s good for creators. So if they’re using Karat. I should too.

Bringing on Creators as investors they are aligning creators incentives with theirs. Their customers now become their salespeople, using their social presence and charisma to grow Karat’s customer base.

This also led to Karat’s very intentional customer acquisition strategy.

They understood that creators are inherent distribution channels. And they leveraged this.

Let’s look at their first product: The Karat business credit card.

Notice anything about it?

It looks exclusive. It’s a weighted, metal, black card. It appealed to creators' egos.

This card combined a user pain point with a viral organic growth hack. Appealing to the heart, the mind, and the ego.

In fact, Karat haven’t spent any money on creator sponsorships. At least not directly.

Instead, they have made the most of creators' virality, continuously using organic growth hacks.

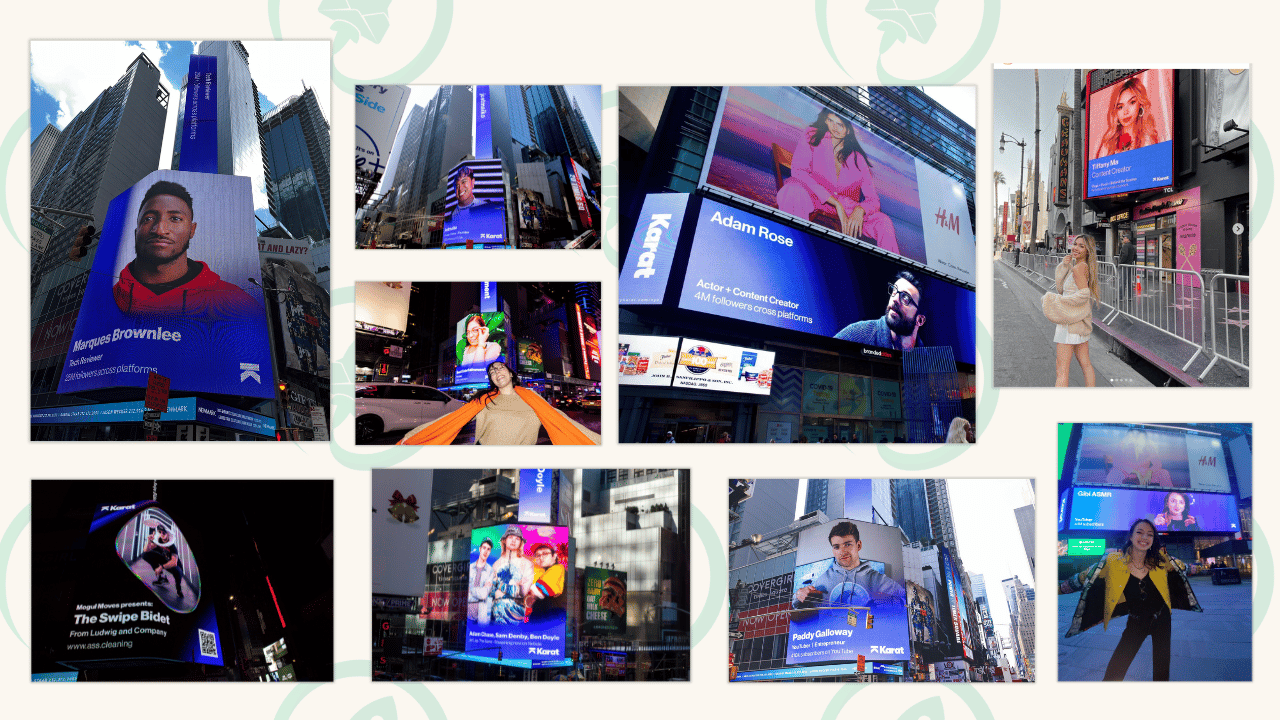

Their most iconic example is probably using billboards in Times Square and LA to promote their customers who earn enough credit card points.

This works so well because everyone wins.

Creators get mainstream exposure and validation.

Then they share this exposure with their audience, giving Karat more exposure and validation as well.

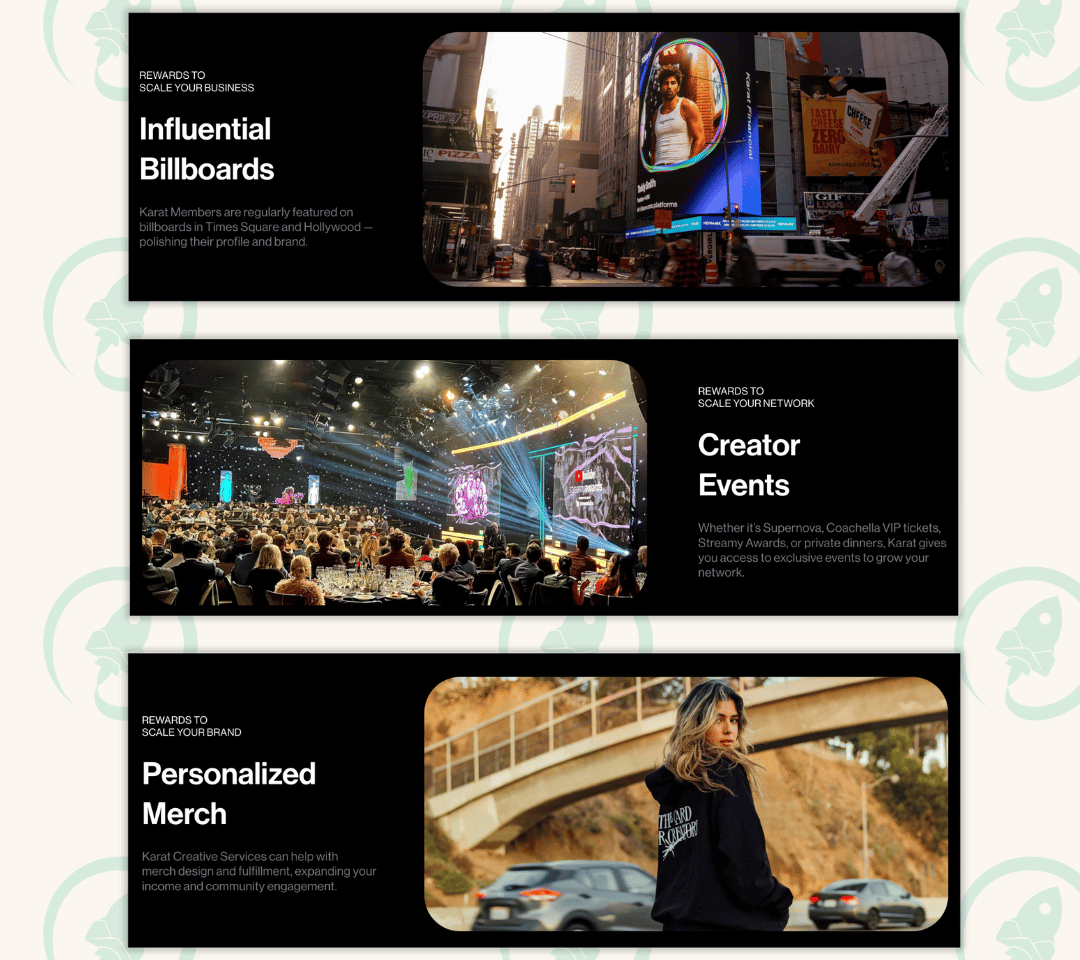

Let’s go back to Karat’s points system. The system is designed to intersect hyper-curated rewards for creators and maximize organic virality for Karat.

For example, other reward options include creator events such as the Streamy’s, Coachella, or their own shark-tank-style creator pitch events, Supernova.

As Karat puts it, their personalized rewards are meant to scale your business, scale your network, and scale your brand.

💳 4. Being intentional when raising money

Raising venture capital isn’t just about the finances. There is so much more that your investors can offer you: experience, expertise, distribution, and networks to name a few.

Eric and Will understand this.

They have raised from Twitch Co-Founder Kevin Lin, YouTube Co-Founder Steven Chen, and Twitter Co-Founder Biz Stone. Who have been able to provide experience and expertise to grow in the Creator Economy.

They have also raised from leading Creator Economy and FinTech VC Union Square Ventures (prev. Investments include Twitter, Tumblr, Stripe, and Coinbase). Who have been able to support Karat as a Creator Economy financial enabler, while also providing access to their network.

Karat also has over 70 creators on their cap table. Providing an exclusive pool of customers and a distribution network of top creators, in various niches, including Graham Stephen (finance), Alexandra Botez (chess), Ludwig (entertainment), Nick DiGiovanni (cooking).

Karat has also raised money from celebrities such as Will Smith, opening up more mainstream entertainment channels.

Often startups jump at the chance to raise money. Who would turn down money if it’s available right?

But the problem with that is that there is no intention.

Karat however, didn’t do this. As I mentioned earlier, Eric and Will were extremely intentional about why they were raising money at each round:

Seed: Are creators a big enough market? 🔎

Series A: Are creators businesses? And what is the right product to prove this? 🏭

Series B: Can they be cross- and up-sold on other products? I.e, can Karat become profitable? 💸

After each raise they were focused on answering the relevant question.

This gave them the ability to be hyper-focused and intentional on how they spent this capital. Leading to efficient capital usage.

Actions you can take to replicate Karat’s success

Karat has been built with a blend of extreme intention and continuous testing. Finding the best way to enter the market before focusing on scale. Doing this, the team has managed to retain focus at each stage of the business.

There is a lot to be learned from Karat’s story. Here are my favorite ways you can replicate their success:

Solve a problem that a group of users deeply care about 👨👩👧👦

There are three main reasons creators need access to capital:

Working capital. Speeds up production of videos.

Business capital to make a much larger investment (e.g., Dude Perfect building a theme park).

Personal credit (e.g., a home loan).

And only reason 1 has high urgency.

There are a lot of creators. But most don’t fit into reason 1. Only the top creators who have high video costs have an urgent need for Working Captial.

But this isn't a problem. In fact it’s a lesson.

Because although there’s only a small number of creators who have this problem. It’s a problem they care deeply about.

It’s better to solve a problem that a small number of people care deeply about than a problem a large number of people only kind of care about.

Karat first tried to solve a problem that deeply affected top creators. Then other creators followed.

So think about whether your product is actually solving a problem that a group of people care deeply about.

Lean into your strengths

One thing I noticed about the dynamic between Will and Eric is how they complement each other and the business.

This isn’t a coincidence.

It’s because although Will and Eric balance responsibilities in all aspects of the business, they have leaned into their strengths in certain areas.

Will, for example, has leaned into his more business oriented strengths - focusing more on growing the team and thinking about the long-term strategy and vision.

Whereas Eric has leaned into his ability to build relationships - focusing more on the creator side of the business. Networking. Attending conferences. Speaking to and supporting creators.

You can think about the job of a founder as four categories:

Vision and Brand 🎯

People 👭

Product ⚒️

Money 💵

Although you need to touch all four together with your Co-Founder(s). You should lean into your strengths and find Co-Founder(s) who complement these strengths. Allowing for more focus and a better end product.

For example, if you think you are extremely strong on the people and product side. Find Co-Founders who are stronger on the vision and money side.

You’re trying to build a complimentary team where you can all lean into your strengths.

Think about how you can serve connectors

Creators are rare in that they are connectors, mavens, and salespeople all-in-one.

But most critically, they are connectors.

If you have a good product (and you’ve tested it). Connectors are the ones who will make it viral.

Find connectors in your industry and find ways to acquire and serve them.

Go on LinkedIn and see who the leading voices are in your industry.

Start networking, going to events, speaking to people in the industry. You will start to recognize names and faces. You’ll see who’s always there. Who’s speaking at events. Who knows everyone.

Those are the people you should go after. They will be your best brand ambassadors.

For The Zero to One, it’s been your host, Sheldon.

Speak soon and stay awesome!